MANILA, Philippines – Today’s new generation of entrepreneurs has to navigate a fast-changing business landscape. Technology and customer habits are constantly evolving, so many new business owners are seeking smarter, simpler ways to streamline their daily operations while ensuring they manage and grow their businesses effectively.

For Marc Gan, Ched Hilado, and Princess Potot, GCash for Business has become their partner in making many aspects of running their businesses easier each day. With GCash for Business and its various products, they can manage transactions more efficiently in-store, receive payments daily on a separate business wallet, and even pay their suppliers through an exclusive portal.

Here’s how they experience easy everyday with GCash for Business and why these tools should be on your radar if you’re a small biz owner:

Seamless payments save time and add convenience

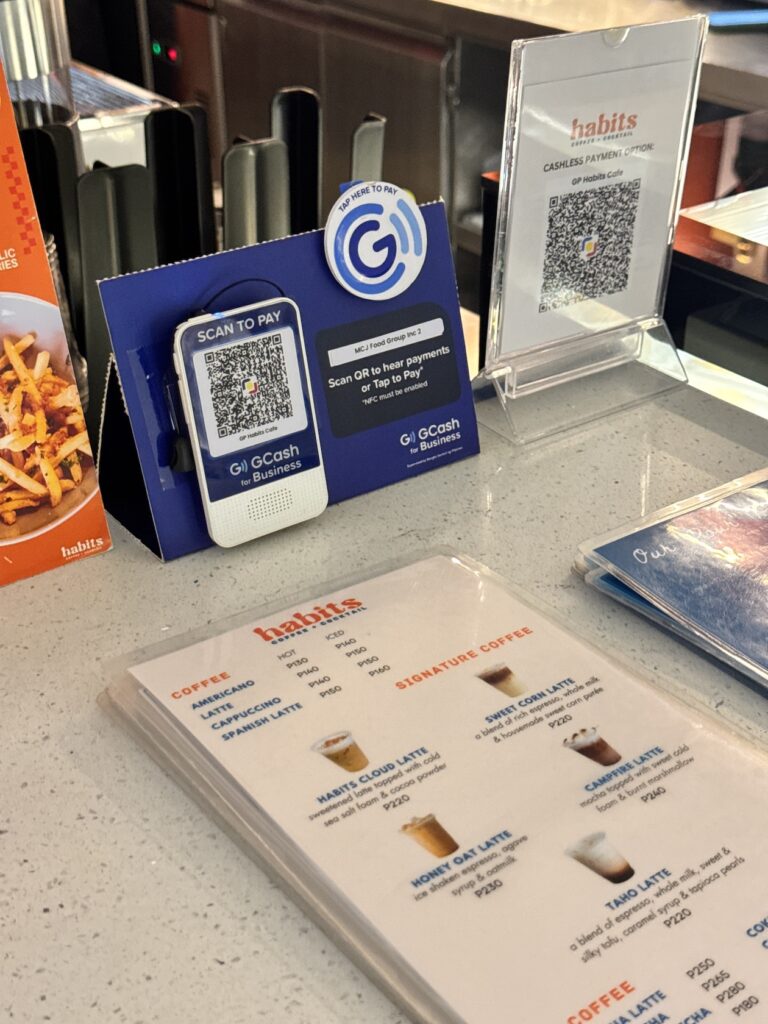

Running Davao’s newest hangout, Habits Coffee + Cocktail Bar, means staying quick on your feet, something co-founders Marc Gan, Melvin Teves, Jahnikka Baricuatro, and Franz Villanueva know well. With GCash SoundPay, their transactions are faster and smoother, allowing them to keep up with their customers.

GCash SoundPay is a portable device that provides instant confirmation anytime, anywhere. It allows customers to make cashless payments by simply scanning the merchant’s GCash QR code. Once payments are made, it generates an instant audio confirmation. Payments through GCash SoundPay are sped up and secure.

“The instant voice confirmation for every successful payment means we never miss a sale, and our customers love the convenience. It’s simple for our staff to use, and it helps keep our operations running smoothly,” the team shares.

Before GCash SoundPay, Marc and his team handled a lot of cash, which often slowed down service. Now, with instant voice confirmation letting both staff and customers know that the payment went through, Marc and his team can speed things up at the counter.

Accurate payments and proper recording mean no missed sales

From just selling their burgers at weekend markets to now running three branches across Bacolod and Dumaguete, Das Burgery owner Ched Hilado knows firsthand how managing cash payments can be a headache and lead to errors. Since onboarding with GCash for Business and deploying GCash SoundPay to all her branches, the experience has improved greatly for her and her team.

“When we receive the audio payment confirmation that indicates payments are received, we are assured that the money has entered our account,” she explains.

Organized finances help business owners plan for growth

For 3rdfloorespresso Cafe in Butuan City, owner Princess Potot recalls the struggles of mixing personal and business funds in her personal GCash wallet before she switched to GCash for Business.

She explains, “I had a QR for GCash, but it’s personal. So, what happens is that it’s connected to my personal money, which is a long process when it comes to recording, accounting, because your personal transactions are mixed up.”

Princess highlights how the new GCash for Business Portal changed that. With the new GCash for Business Portal, businesses get access to an easy-to-use platform to track and manage all online transactions in one place. It includes a simple, easy-to-use payments tracker and management system, no wallet limit when receiving cashless payments from customers, and no transaction fees when paying suppliers through GCash or bank transfers..

“It’s really easy when it comes to recording sales. It’s very friendly for new business owners, because it can do your records, manage your finances, and all the things that help you do your work easier” says Princess.

Enter Your Easy Era with GCash for Business

If you’re a small business owner looking to enter your “easy era,” these new solutions from GCash for Business offer a simple way to modernize how you manage payments so that you can focus on what really matters: growing your business. Aside from GCash SoundPay and the GCash for Business Portal, the new GCash PocketPay is a recently-launched innovation made especially for MSMEs that turns their phone into a POS machine! It enables business owners to use their Android NFC-enabled smartphone to accept credit card or debit card payments, track inventory and business transactions through the same phone, and get fast settlements for every payment.

Signing up for these solutions is as easy as 1-2-3!

- Create an account on the GCash for Business Portal. You can get started as a merchant using just your verified GCash account of at least 12 months to qualify for a Starter Plan.

- Order a GCash SoundPay device or GCash PocketPay.

- Wait for your email confirmation on your GCash SoundPay delivery, or download GCash Pocketpay on the Google Play Store.

For more information on how GCash helps empower businesses, visit GCash for Business.