JJ Atencio on using the quarantine to reexamine one’s wealth & develop an entrepreneurial mindset

If there’s anything the COVID-19 pandemic revealed, it’s the fact that an economic standstill renders everyone’s finances limited, or worse, at risk of depletion. Corrolarily, it has become more apparent how wise saving and observing a frugal lifestyle can trump the paycheck-to-paycheck sinkhole most of us get trapped in.

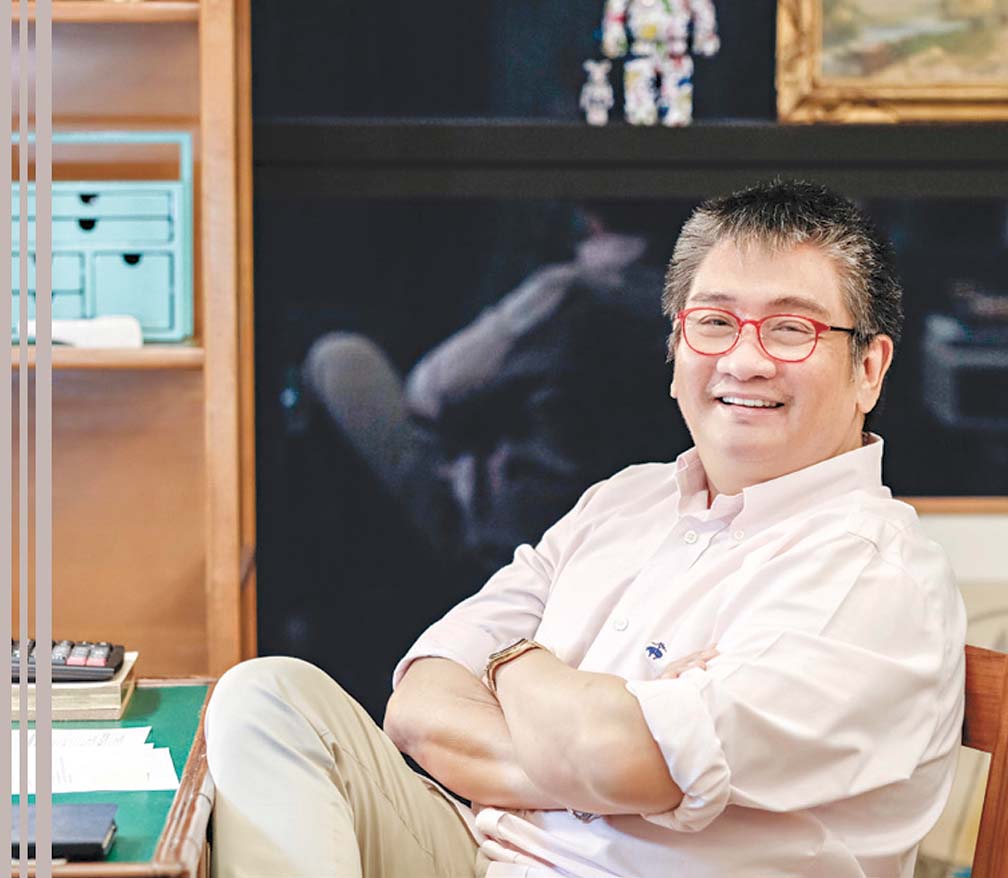

To find out how we can actually be ‘wise’ with our earnings, we decided to interview, Januarius Holdings CEO JJ Atencio, an entrepreneur-turned-investor, on best practices on financial readiness in times of unmitigated disasters like the COVID-19 pandemic.

Is investing the answer in times of an economic standstill because of unmitigated disaster?

While investing is a great way to compound one’s earnings, ideally, it’s a venture reserved for those who meet certain requirements—one of them being in possession of surplus income. If you don’t have surplus income, it is totally useless to even consider investing.

There are a number of factors to investing. One could be your debt level. You may not have sufficient income because you have personal debt—either you have advancements from your employer or you’ve maxed out on your credit cards that you are now paying on revolving terms. Securing that is a requirement.

The next thing is your primary source of income, particularly if the enrichment level is satisfactory. You spend one third of your life in your job. That eight hours spent in a day must be value-adding and enjoyment-inducing. If not, maybe it’s time to look for other opportunities. Maybe you need to reassess the current state of your career, maybe you need to look for a better paying job or take up courses or attend seminars on financial literacy. Opportunity, knowledge, and perhaps, a bit of motivation are, in a way, a form of investment that will allow you to better manage your cash flow.

Is securing a living space a good investment?

You can invest on two important things: your living space and an excellent insurance product. For the former, it is important to have a place to live in as early as possible. Why? Because in the PH, rentals constitute a high portion of disposable income—sometimes as much as 40% goes to rent. If you can transform rental into homeownership with a monthly amortization, you’re actually paying for something that will bring you dividends eventually in the future.

Most people postpone buying a residence thinking the monthly amortization is too high. The thing is you may never be ready at all, but whether or not you invest today, in 10 years time, 10 years will have passed either way. So find a way to do it now. Assets have a tendency to appreciate. You have many years of increasing incomes. You’re young, you’re gonna get promoted, you’re gonna study some more—and if luck is with you, you may even marry rich—overnight that could perhaps solve your financial problems. For those reasons (and because of the declining value of money), your monthly amortization today may be pennies in five or 10 years-time.

How does one find an excellent insurance product and other forms of investment?

Go for insurance products that not only insures you but actually gives you a dividend on an investment. The younger you get a great insurance policy, the much cheaper it is in the long run.

So now you have your home, you have your insurance, and you generate surplus income. Time for the next legitimate investment on the table: fixed income bonds. By this time, you surely have your own bank account. What you do is you talk to your branch manager and ask for fixed income bonds from their trust group. The goal is to look for fixed income instruments compatible with your risk appetite. The safest form of financial investment (and the easiest to secure), fixed income bonds are liquid enough for you to exit at any time without waiting.

What are must-haves for starting a business?

Once you have insurance, your own home, and fixed income, then you‘re ready to consider getting into a business. There is a list of crucial entrepreneurial must-haves: First of which is one’s own capital. Now, can capital be loaned? Can it be borrowed? Well, no, because if you borrow capital and start a business, I will tell you this, you end up working for the bank.

Second is experience. It’s not enough that because you like to eat, you decide to open a restaurant. It doesn’t work that way. You have to have a considerable amount of experience in the field you want to penetrate to be considered well-versed and not make any rookie mistakes.

The third comes in the form of connections—which you can only get if you have some experience. You have to stay in that specific industry long enough so that you get to know people and people get to know you. More so if you’ve had the chance to help people achieve their goals, just so, in return, they can help you achieve yours. That kind of network is crucial if you want to start a business.

What is the best age to start a business?

While many start out with a good idea and proceed to talk to investors with seed money for growth, in most cases, nine out 10 of those companies actually fail. As far as age is concerned, studies have shown that the best age to start a business is 45. At 45, you have some capital, you have some experience, and you have some connections—which you don’t have at 25.

It is in later stages in life where wisdom and insight become more apparent. It’s where you learn to pause, prioritize and reflect on the choices you have to make on a daily basis.

For entrepreneur-turned-investor JJ Atencio, one fitting example of good business smarts is investing in a better alternative nicotine delivery system. He admitted to owning multiple IQOS units for added convenience, compared to continued smoking.

Once a heavy cigarette smoker, Atencio said that IQOS is an alternative nicotine delivery system that heats tobacco instead of burning it. It’s cleaner, there’s no ash. I don’t have to worry about where I put my ash or cigarette butts. My clothes smell nicer. This gadget solved a lot of smokers’ problems.”

He added: “If you’re a smoker, shifting to IQOS is one of the most polite things you can do. Not only that, shifting to IQOS is also the best gift you can give to your spouse. Any spouse will appreciate the fact that you don’t pollute the air anymore.”

In parting, JJ names a secret fourth business ingredient that is, as it turns out, hard to come by. “It’s the X factor— could be the grace of God, perhaps luck. While timing does play a part in a venture’s success, what is more important is the drive to keep going and rise up despite facing failures, one after the other. ‘Failure is part of life. What isn’t is quitting.’”

A great entrepreneur is, after all, measured by the instinct and intuition honed from the challenges one had surpassed and learned from.

Emphasizing the importance and the value of growth, including the ability to adapt from failure, Atencio concluded: “One of the things I realized is when you invest, you don’t invest in business, you invest in people. Beyond the numbers, one has to be comfortable with the people one wants to do business with. A commitment to integrity should always be present as well. Interpersonal fit is to be considered if one wants a business to thrive.”