MANILA, Philippines – Despite the wide range of solutions available in the market, many micro, small, and medium enterprises (MSMEs) find that existing tools often feel intimidating, costly, and out of step with their stage of growth. GCash for Business aims to break down these barriers by making business solutions more accessible and affordable. In doing so, GCash for Business empowers even the smallest enterprises to grow, compete, and thrive in today’s evolving business landscape.

This is what GCash for Business aims to solve with its business solutions that are easy on the pocket and easy as 1-2-3. Through GCash for Business, MSMEs get access to payment solutions that are simple and affordable. Merchants with a fully verified GCash account can explore its various solutions, such as the new GCash PocketPay and GCash SoundPay.

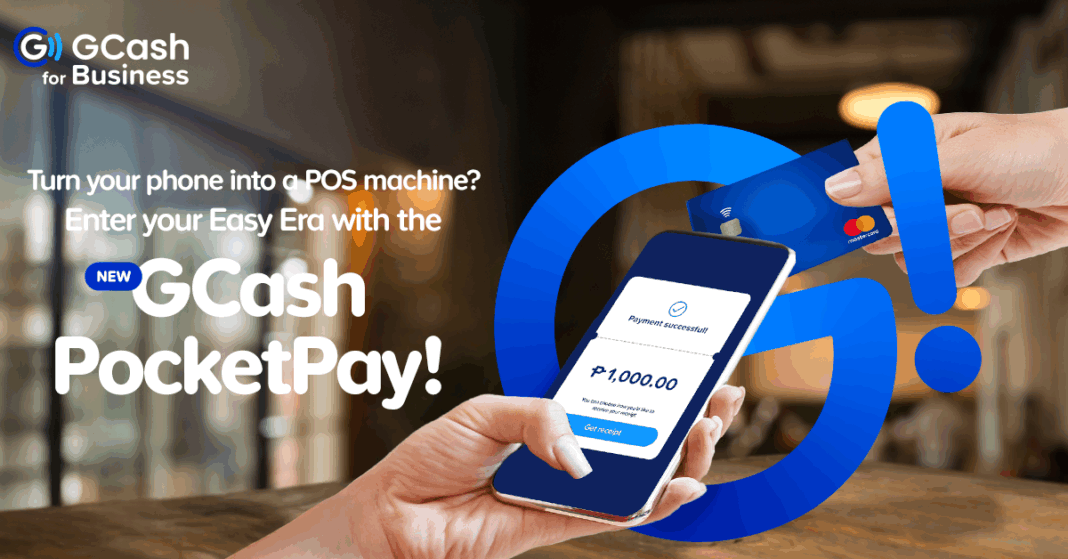

Introducing the New GCash PocketPay

Expensive payment terminals and complex set-up processes have long been a barrier to accepting cashless payments. But with GCash PocketPay, even the smallest of businesses can now do more with just their smartphone. There are no upfront costs for additional hardware; they simply need to download the app. And it’s very easy to set up, something that GCash for Business believes will encourage more Filipinos to enter their easy era of doing business.

“Digital tools have to work with how MSMEs live and operate, and for many of them, that means operating on lean budgets and fast turnarounds,” says Jong Layug, General Manager of B2B of Mynt. “GCash PocketPay meets them where they are with a solution that’s flexible, reliable, and incredibly easy to use. This is part of our goal to provide simpler and more affordable digital payment solutions that allow them to do more with less.”

Through GCash PocketPay, their smartphones function as POS machines, expanding the business’ capabilities to accept card payments. It ultimately removes any issues with payments, while making the business more accessible to a wider range of customers who prefer cashless, card-based transactions. It’s perfect for business owners who operate in pop-up spaces, move around for deliveries, or run online stores from home, as they get fast settlements for every payment and can track transactions through their phones.

It also removes the steps to confirming digital payments, such as asking customers to show receipts of their transfers or double-checking your text inbox for payment confirmations, giving peace of mind, reducing errors, and saving valuable time. All customers need to do is tap their cards on their smartphones, and payments will be accepted via NFC.

As GCash for Business continues to support Filipino MSMEs in their digital journey, solutions like GCash PocketPay are built with one thing in mind: ease. GCash for Business aims to usher more businesses into their easy era, a time when business owners no longer have to stress about expensive costs for tools that will help them grow. Sign up on the GCash for Business Portal to get started and download the GCash PocketPay app to enjoy zero fees until December 3, 2025.

For Miguel Escueta of café and restaurant Frank & Dean, GCash PocketPay was a welcome solution, especially for the brand’s corporate office locations, where customers often come in waves and the queues get long.

“It has made doing business more convenient, especially at our corporate office locations, since we mainly use GCash for those branches. Having a 3rd option to cash and e-wallet payments has been very helpful, because a lot of customers transact using credit cards, and now we can ease that process with GCash PocketPay,” Miguel explains.

For their team at Frank & Dean, tech solutions like GCash PocketPay aren’t just convenient. They also play a big role in speeding up growth, proving how openness to new tech can make operations run smoothly.

“Don’t be afraid to use digital payment options,” he advises. “We find it more convenient than cash. It is safer, and there is no need to do bank runs to deposit cash sales. It is also easier to monitor with the daily reports being sent.”

GCash for Business: Payment Solutions for Every Business

As new businesses continue to sprout up and expand, simple yet powerful solutions like GCash PocketPay can make the difference between staying small and scaling up.

GCash for Business also introduces GCash SoundPay, a portable payments solution that accepts QR payments and gives instant voice confirmation every time a customer pays. Available at flexible rates, GCash SoundPay is compact, easy to carry, and designed for convenience for businesses, without interrupting their service flow.

Business owners can find both payment solutions through the GCash for Business Portal, where they can easily register, order their devices, and manage transactions. Once onboarded, they just need to download GCash PocketPay by GCash for Business in Google Play. Discover more solutions and sign up today https://business.gcash.com.